Pakistan Monthly

31. January 2022Global development of spun and filament yarns

18. March 2022This article is a summary of the presentation delivered at the 3rd International Conference on Cellulose Fibers in Cologne early February, describing main characteristics seen last year, 9-month textile and apparel exports, structural changes in fiber supply and an outlook on what to expect next.

Characteristics in 2021

A recovery in demand was noticeable after Covid-related lockdowns were lifted but at different regional pace. The comparison with pre-pandemic 2019 year shows that apparel retail sales in the United States exceeded the value by 12% while textile consumption expenditure in Japan remained nearly 20% lower and 10-month apparel imports into European Union were short more than half a million tonnes.

Sustained strong demand was seen in applications such as home textiles, hygiene, medical, wipes and filtration while modest recovery occurred in apparel, ranging from strong demand for sportswear to hosiery at a level lower than 2019 and formal wear still depressed.

Consumption for mobility end-uses is a long time coming given the automotive crisis due to semiconductor shortage with an estimated global loss in vehicle production exceeding 10 million units and commercial aircraft deliveries were still a quarter below pre-pandemic volume with an anticipated delay in recovery for twin-aisle aircraft serving international routes.

U.S. consumer prices rose 7%, a number we have not seen in almost 40 years, with energy prices up by 29% in the 12-month period and used vehicle prices due to limited new vehicle production soaring 37%. Euro area annual inflation was 5%, marking a historic peak for the euro currency, including energy prices soaring 26%.

Escalating prices of fibers and yarns and of feedstocks at even faster pace led to squeezed margins at spinning stage and tight raw material markets were result of maintenance outages, several force majeure declarations and adverse weather conditions that limited availability.

Logistical issues were another serious concern throughout the textile chain following a lack of truck drivers, delays at congested ports, container shortage and misplaced containers. Elevated see freight rates, delayed and uncertain delivery times out of Asia caused significantly lower import pressure, which helped spinning industries in Western world to raise operating rates.

Lack of workers, COVID-induced restrictions of working hours, migration of workers and the need to train new staff lowered productivity and caused temporary shutdown of spinning lines. Companies competing for scarce workers faced wage increases which further added to the production costs.

A special feature has been seen in the U.S. market, so-called “Great Resignation”, with rapid pace of people quitting their jobs in search for better pay or better jobs. An unprecedented number of more than 45 million last year dropped out of the labor force. Changing priorities due to the pandemic is probably not the only reason. Even if it appears questionable whether this trend will spread globally, it is certainly another threat to labor-intensive industries such as apparel business in particular.

9-Month Textile and Apparel Exports

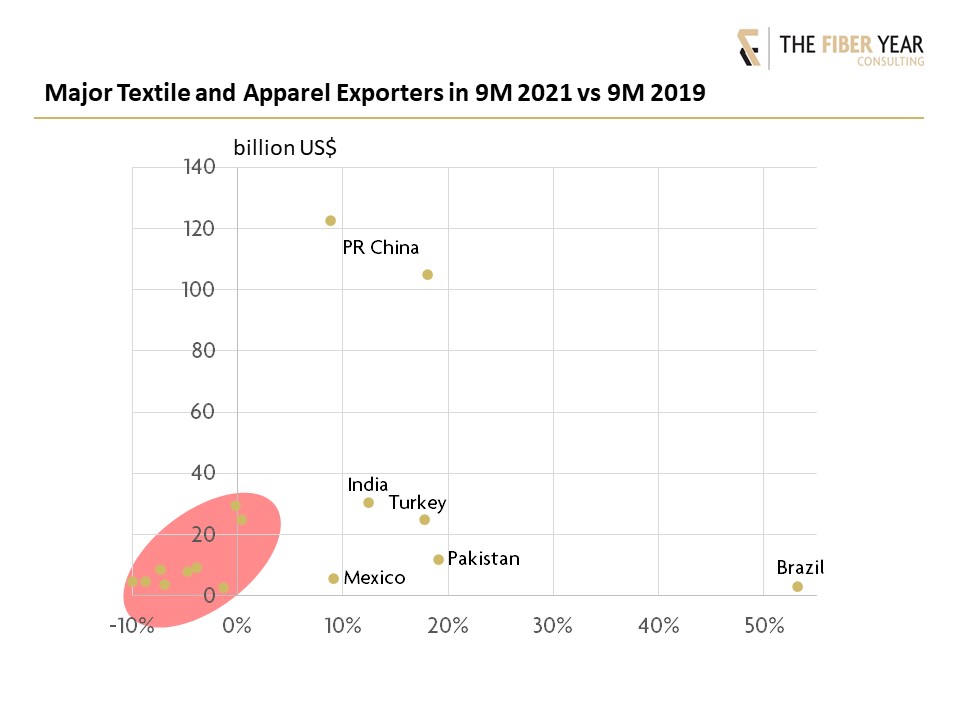

It is obviously not a broadly-based recovery during the first three quarters as quite a number of countries in the light red marked area still are below pre-crisis level – such as Cambodia, Indonesia, Korea, Malaysia, Myanmar, Sri Lanka and Thailand – while Bangladesh and Vietnam are tolerably stable during the first nine months.

Of course, all nations succeeded to expand their export values over 2020 – a year with unprecedented lockdowns across the globe – with just one exception – PR China! Chinese textile exports softened 11% as result of a general drop in prices of face masks rather than significant reductions in quantity. Meanwhile, apparel exports gained 25% and full year results will show a trend reversal after six years of gradual decreases in garment shipments.

Skyrocketing export value expansion from Brazil of more than 50% over pre-crisis level benefited from sharp growth in cotton harvesting and large stocks, both allowing to significantly lift exports of raw cotton. Further gains may come into reach as cotton prices marked a 10-year high in mid-November.

The export business in Pakistan is set to hit a new all-time high, essentially driven by imports of raw cotton and viscose fibers while also domestic polyester manufacturing witnessed dynamic growth. Record high is also visible in Turkey with the industry clearly benefiting from elevated shipping costs out of Asia and regional sourcing with an expanded share into the European Union.

Structural Changes in Fiber Supply

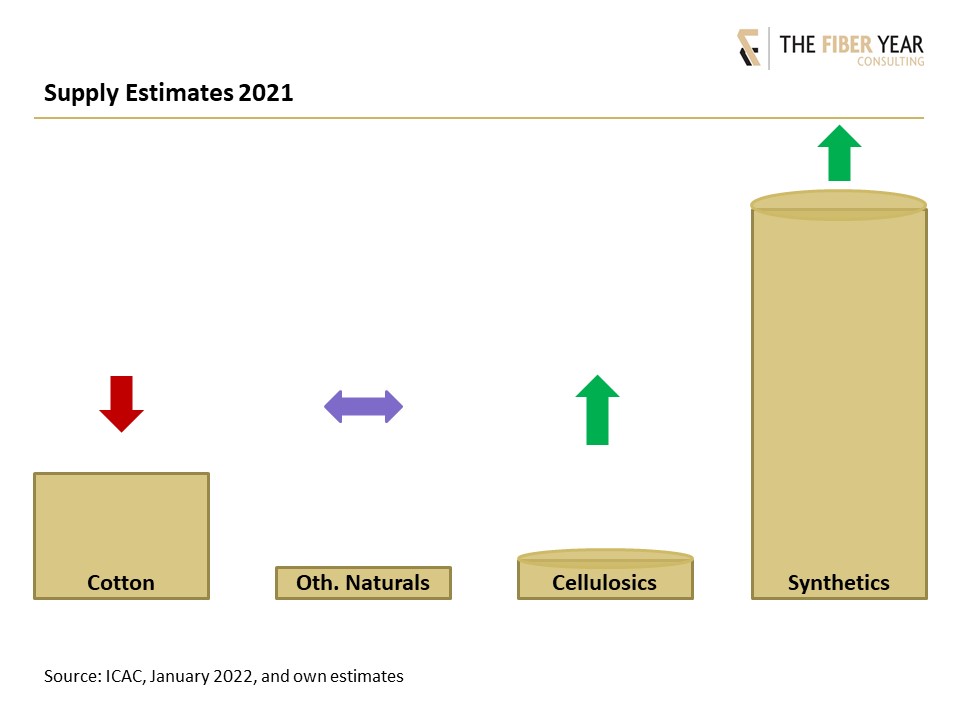

Last year has seen some structural changes in the world fiber supply. Cotton production in 2021 was – as expected – replaced by the sharpest decrease in 5 seasons. Other natural fibers are expected to be tolerably stagnant despite sharp contraction in flax production. The manmade fiber business saw a recovery in both wood-based cellulosics and synthetic fibers. Cellulosics succeeded to expand at the fastest pace in 8 years while the recovery in synthetics was primarily driven by polyester thanks to their advantages in price.

Outlook

Before throwing a glance at what to expect next, it is advantageous to recall lessons learnt so far.

Firstly, a revival of local manufacturing in our industry remains unlikely, we will be seeing probably a mild shift to be prepared for supply disruptions in future and short-term peaks in demand. Countries realized the importance of being able to supply themselves and any changes in future sourcing may well occur for essentials of life but apparel is neither strategic nor essential but just a fashionable item with ongoing pressure on prices. Relocation of processing chains from low-cost countries seems implausible and to safeguard against future supply-chain shocks is not a strong argument to re-shore large garment capacity to higher-cost domestic markets in the age of shareholder value and quarterly earnings reporting.

Secondly, the world will not return to what life was like before but rather adjust to a „new normal”, which will be on a lower level we all got used to before.

Any prediction still appears highly speculative as nobody knows the further course of COVID-19 and whether any potential new variants will pop up to depress economy and exacerbate economic situation. On top, several negative and burdening parameters we had to cope with last year still are in place and even further gained momentum, in particular the rapidly rising feedstock and energy costs that both affect margins at spinning stage.

When the foresight means a leap in the dark, it is recommended to learn from history. Some of you may recall the first oil crisis in 1973. It went along with rapidly rising feedstock and energy costs, like we have been facing currently, with a 2-year dive of synthetic fiber output. Of course, changing market forces need to be taken into account. The global share of synthetics almost 50 years later of around two thirds by now is difficult to compare with synthetics occupying just a quarter of the market back then. However, it may indicate the chance for wood-based and natural fibers to tap into markets and applications they used to serve in the past.

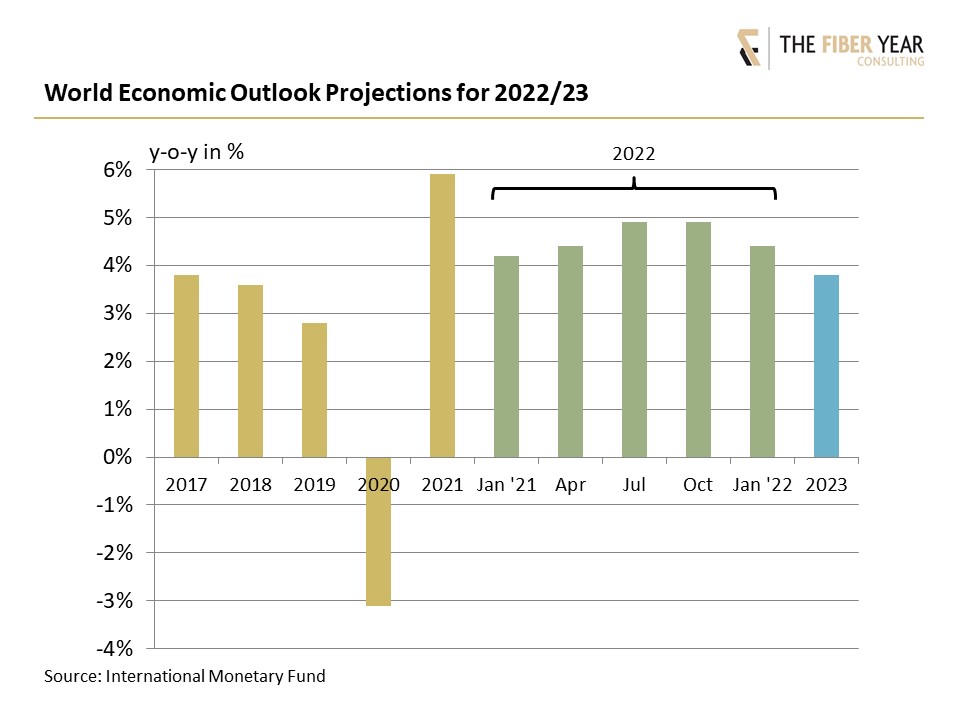

Latest IMF projections from last week suggest global economic growth is in the middle of a descent from 5.9% expansion last year to a downwardly revised 4.4% this year and a further slowing to 3.8% next year. The green bars show that optimism gave way to adverse conditions we currently have many to deal with.

Annual population growth last year – for the first time ever – went below 1% and is subject to further deceleration together with elevated inflation and high energy prices that are both lowering disposable income for textile applications call for adjustments what to expect from future textile supply and demand. Future growth will come into being at softer than expected dynamics, thus, the v-shaped recovery after financial crisis may rather look like a stretched u-recovery compared with pre-pandemic projections.

However, commitments everywhere for sustainable fibers and corresponding project announcements seem to brave the slowdown with wood-based fiber expansions anticipated to significantly enlarge global supply. Touching the sustainability issue requires to keep in mind that it is not just about sustainable raw material sourcing but also an environmentally responsible production process. That is the reason why the industry will increasingly shift to the lyocell technology that has a sporting chance to lift its segment share from about 5% at present to around 20% by 2025 if all announcements will come on-stream. They will experience breathtaking dynamics driven by their eco-friendliness as they do not need much water and no pesticides other than cotton and almost all chemicals used in the process can be recovered.